Forex trading is gaining popularity with each passing day. But what is forex, and how does it work? Simply put, forex trading involves buying one currency while selling the other. The traders aim to profit from fluctuations in the relative values of the assets.

Forex trading for beginners is lucrative, primarily due to the easy market access. Additionally, traders can trade several currency pairs at any time they want. Due to its flexible nature and high liquidity, it is a favorite of many.

However, beginners need to understand the basics before investing any real money. It helps them make well-informed decisions with a disciplined approach. Tradin is a broker that offers you the opportunity to trade the forex markets with several great features. Here’s a beginner’s guide to forex that includes:

Currency trading basics

Best forex trading strategies for beginners

Common forex trading mistakes to avoid

Chart reading basics and key forex terms

Ready to trade the forex markets? Join Tradin today to trade forex markets hassle-free.

What is Forex Trading?

The foreign exchange market, also known as the forex market, allows banks, funds, institutions, and individuals to buy/sell, or exchange currencies for both hedging and speculative purposes.

In the forex market, currencies are traded in pairs. The pair represents the exchange rate between the two. The exchange rate tells about how many units of the quote currency are necessary to buy one unit of the base currency. For instance, in EUR/USD pairs, the euro is the base currency while the dollar is the quote currency.

Additionally, it is a decentralized market that has 24/5 accessibility, covering all global trading sessions. By far, forex has the highest trading volume in the world.

The major pairs include the USD next to any other currency. For instance, EUR/USD, USD/JPY, and GBP/USD. The minor pairs include two major currencies combined, except for the USD, such as EUR/GBP, GBP/JPY, etc. The exotic pairs include any major currency paired with one from an emerging economy, like USD/TRY (TRY stands for Turkish Lira), etc.

Why Do People Trade Forex?

The reason forex trading captures people's attention is its potential profitability, if traded correctly. It is easy to trade as a beginner since it has a low entry capital and mainly operates virtually. Additionally, the global market liquidity offers speedy execution and numerous trading opportunities.

Forex Trading Basics Every Beginner Should Know

Here are the basic concepts that a beginner trader must understand:

How Leverage Works in Forex Trading

With leverage, traders can manage big positions with small funds. Beginners should start with moderate leverage and avoid overleveraging. Leverage amplifies both profits and losses. Using leverage without proper risk management can be detrimental to your trading.

How to Read Forex Charts for Beginners

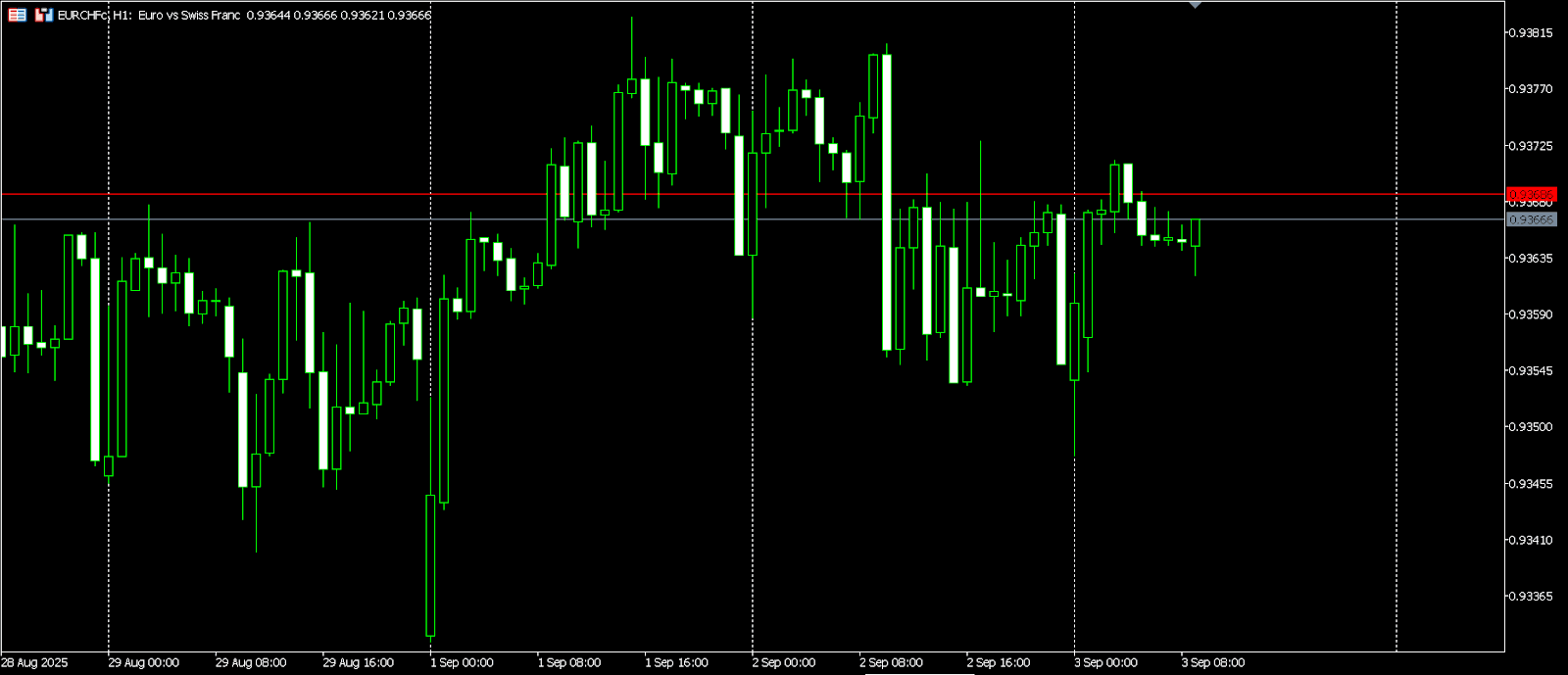

If the traders manage to learn about the market movements, they can effectively read the forex charts. The forex chart has two basics. It displays currency price action over time.

The x-axis illustrates time.

The y-axis illustrates price.

Additionally, there are three types of charts. They include:

Line charts.

Bar charts.

Candlestick charts.

Once beginners have become familiar with market movements, trends, and chart patterns, they can make informed decisions.

Ready to trade like a pro? Join Tradin, a credible broker that lets you deal with small account sizes and beginner-friendly platforms.

Forex Terminology Every Beginner Must Know

To trade forex confidently and successfully, beginner forex traders need to learn all the forex terminologies to avoid any confusion. The most common ones are briefly explained below:

Pip

A pip is the smallest unit of price movement in a currency pair. In forex trading, traders use it to measure the price movements. With pip, traders can accurately differentiate between different currency pairs. For instance, in the EUR/USD pair, a pip typically equals 0.0001.

Ask

In forex trading, the ask is the lowest price at which the seller is willing to sell a currency. Ask is the price that traders require to enter a short position. It is necessary to note that the ask is always calculated to be higher than the bid. For example, the EUR/USD ask is 1.1700. To buy one euro, you need to pay this price.

Bid

A bid is the highest price a buyer is willing to pay for a currency, and it is always lower than the asking price. For example, the EURUSD bid price at 1.1700 means the buyer is willing to pay this price to buy a euro.

Base Currency

The base currency is the first currency listed in a currency pair. One example is EUR/USD, where the euro is the base currency. Also, it is typically equal to one unit.

Quote Currency

It is the second currency listed in a currency pair. In a currency pair, it shows the amount of that currency needed to buy the base currency. For example, if EURUSD is priced at 1.1700, it means that 1.1700 USD is required to buy one euro.

Lot

In forex, lots are the standardized units of currency traded. A standard lot typically consists of 100,000 units of the base currency. Additionally, smaller lot sizes, such as nano and micro, are also traded. For example, nano has 100 units, and micro has 1,000 units. Lot size is a crucial factor in managing risk, as the pip value is directly dependent on it. For example, a one standard lot of EURUSD has a pip value of $10. Same way, a 0.01 lot of the same pair has a value of $0.10.

Leverage

Leverage involves using borrowed capital to increase potential returns. That means traders can manage a significant-sized position with smaller capital. While it amplifies the profits, it also amplifies the risks. For instance, trading with 100:1 leverage means managing $10,000 with only $100 of your own money (the rest is borrowed).

Long

Long means buying a currency pair and expecting its value to increase. If the base currency goes up in contrast with the quote currency, traders earn profits. For instance, going long on EUR/USD means you expect the euro to strengthen against the dollar.

Short

Short means selling a currency pair and expecting its value to decrease. Again, if the base currency depreciates in relation to the quote currency, traders earn profits. For instance, going short on GBP/JPY means you expect the pound to weaken against the yen.

Margin

Margin is the required deposit that traders must hold to maintain a leveraged position. It is not a fee. Traders need it to manage floating positions. Also, if your margin is insufficient, a margin call may occur. For instance, your broker may require a 5% margin, meaning you have to keep 5% of the total position value in your account.

Spread

In forex trading, the spread is the difference between the bid and ask prices. It varies according to the liquidity and volatility. If volatility is high or liquidity is low, spreads will widen. In the case of highly traded pairs, the spreads will be narrower. One example is the EUR/USD that has a bid of 1.1700 and an ask of 1.1701. So the spread will be one pip.

Contract for Difference (CFD)

CFD stands for a derivative that lets traders speculate on price movements without owning the underlying asset. For instance, trading EUR/USD CFDs means betting on price changes, not owning euros or dollars.

How to Get Started in Forex Trading

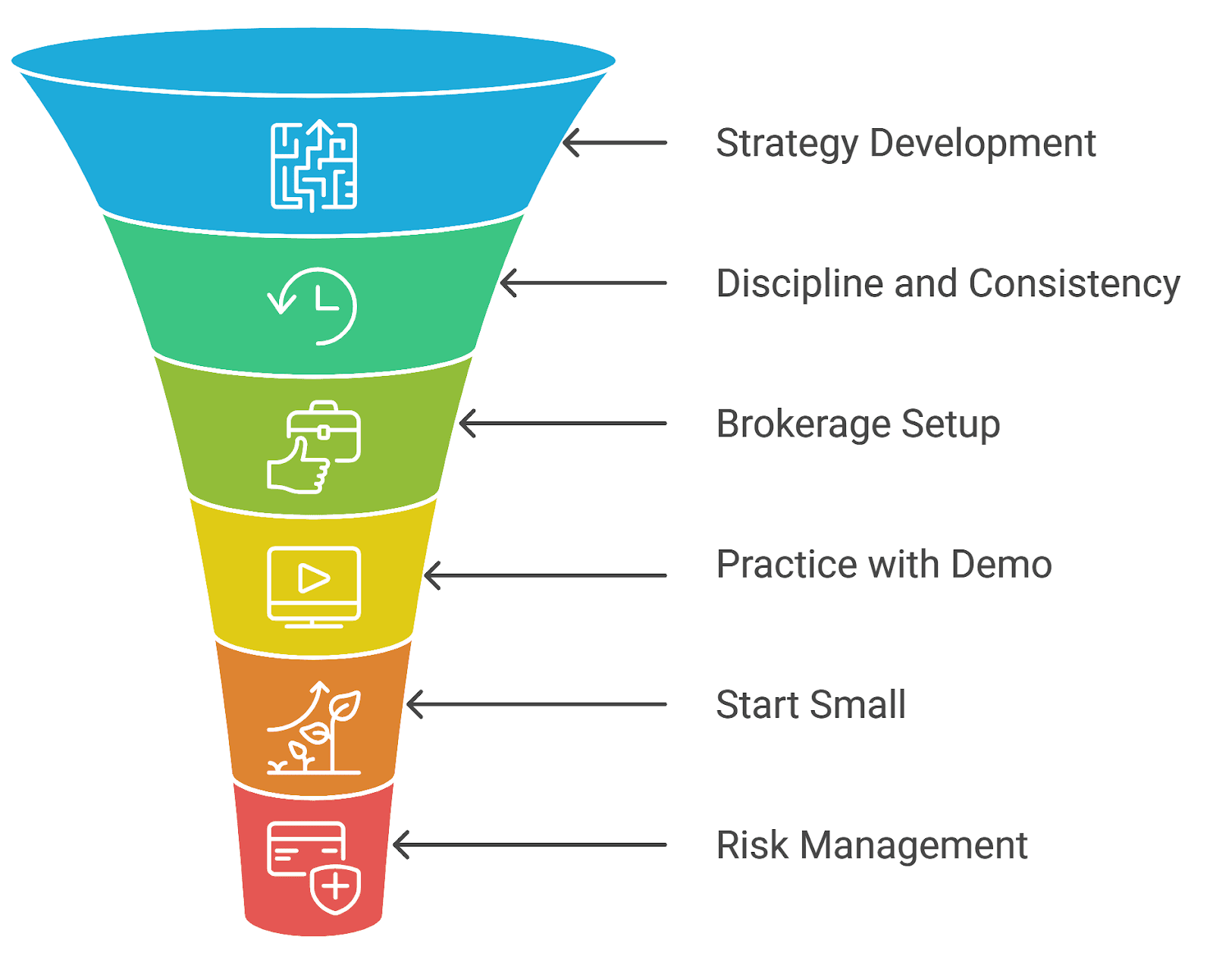

Forex trading holds great potential. However, beginners must understand the basics first so they know what they are signing up for:

Get knowledge about how the market operates.

Set up a brokerage account that has low spreads and commissions, is trader-friendly, and offers a secure, supportive community.

Start practicing with a demo account to practice before going live.

Develop a trading strategy that aligns with your trading objectives, style, and risk appetite.

Ensure consistency and discipline, and avoid impulsive decisions.

Learn how to use trading platforms like MT4, MT5, and cTrader.

Start small and steadily grow your account, and keep regular checks on your position.

To manage risk, use stop-loss orders.

Keep enough funds in your account to sustain it.

Stay updated with news events, geopolitical events, and economic indicators.

As the markets change, adapt your strategy as well.

Forex Trading Strategies for Beginners

In forex trading, there are usually four types of trading strategies.

Type | Definition |

Day Trading | Positions are held and liquidated within minutes or hours on the same day. |

Swing Trading | Traders hold positions for many days or weeks. |

Position Trading | Traders hold currency for months and years until a major trend reversal occurs. |

Scalp Trading | Traders hold positions for minutes or seconds. |

Swing trading strikes a balance between risk and reward, making it ideal for traders who prefer a slower trading pace. Position trading is best because its goal is to grow steadily and thrive in the long run. While scalping can be challenging for beginners due to quick entry and exit, day trading gives slightly more room for the traders to react. Regardless of the trading style you choose, be sure not to overlook risk management. Always allocate 1-2% risk in each position and protect your capital by using stop-loss. Take profits timely and balance your risk/reward ratio.

Common Mistakes Beginners Should Avoid

To maintain their trading account, beginners should watch out for these mistakes. If traders start trading without a solid plan in place and make emotional decisions to curb losses or overleverage, they lose. Additionally, trading without a plan never works well. Be it fear or greed, traders must avoid emotional trading, as that sets you up for failure even more.

Additionally, it is necessary to utilize risk management methods, such as stop-loss orders. Not developing a strategy and avoiding refining it with a demo account works against the trader’s favor. Remember, to survive any market, discipline, consistency, patience, and persistence are your best aids.

Tips for Successful Forex Trading as a Beginner

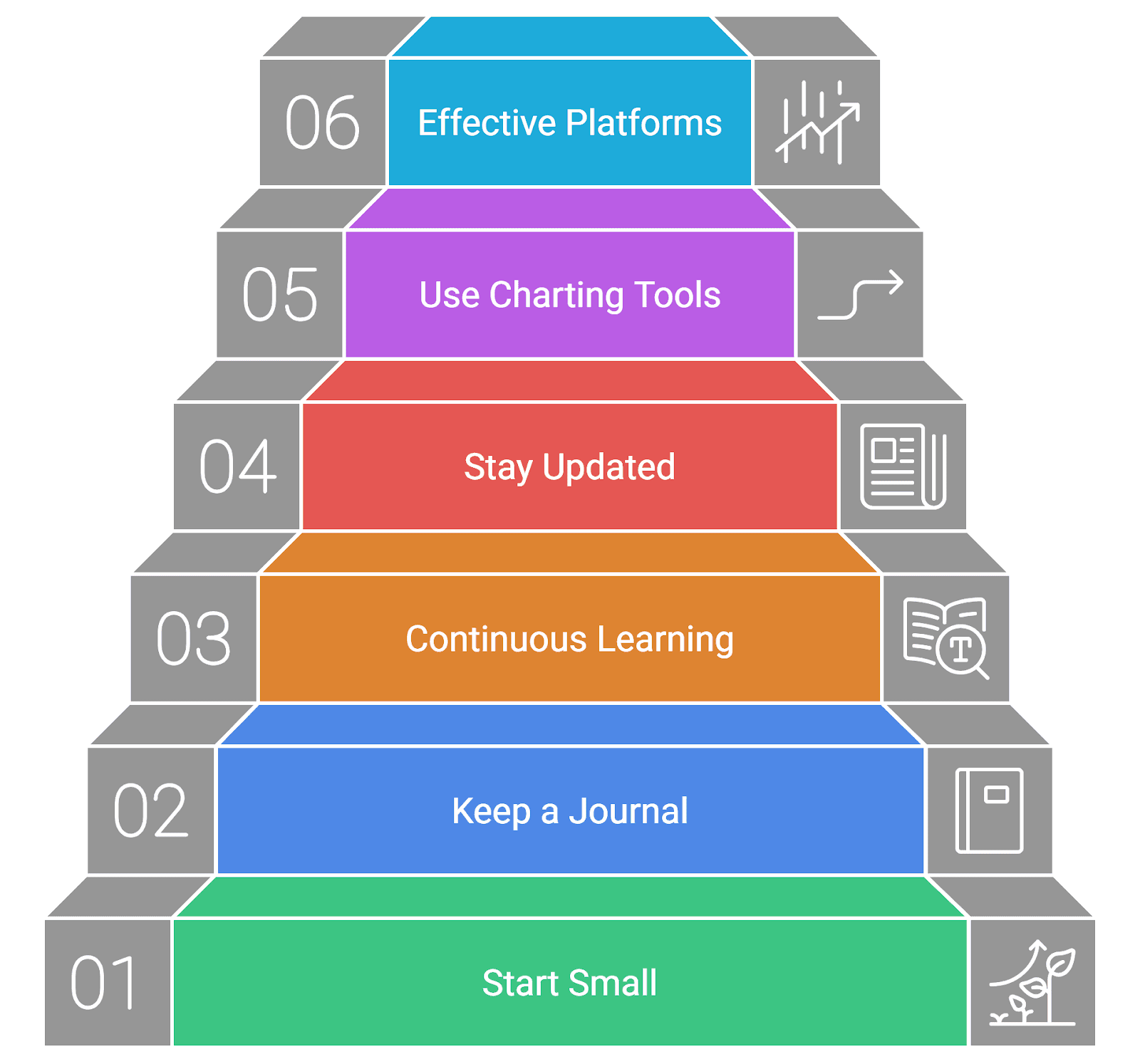

To succeed in the forex game, traders must follow these simple tips:

Start trading with small amounts and scale up gradually.

Keep a trading journal to track your progress.

Be it books, courses, or communities, stay devoted to learning and improving the skill.

Stay updated with the economic news and global events to keep up with the market trends.

Use charting tools for analyzing price movements to avoid making costly decisions.

Use trading platforms like MetaTrader 5 and cTrader to manage trades effectively.

Best Tools and Resources for Forex Beginners

Now you know much about forex trading as a beginner. It’s time to explore the great tools and resources necessary for trading.

MetaTrader 5 (MT5)

MetaTrader 5 is an updated version of MT4, with additional features and benefits. It is a user-friendly trading platform that is popular for its ease of access. It features several built-in indicators, automated trading capabilities, various charting types, a news tab, and numerous other features.

cTrader

It is a modern trading platform featuring a sleek interface, automated trading portal, economic calendar, and copy trading, among other notable features. The platform is ideal for Renko chart traders.

Forex Economic Calendar

The economic calendar is vital for traders as sudden data releases or news events could trigger market volatility. So, traders should know the schedule of such high-impact events. For that, they can use ForexFactory, which is the most popular economic calendar. Moreover, they can use calendars that are by default available in trading platforms.

Is Forex Trading Profitable for Beginners?

When trading forex, beginners need to keep in mind that it is not a cakewalk. Several factors contribute to the market's complexity, including news, geopolitical events, and market volatility. If the leverage can work in your favor, it can work against you as well. Psychological factors, such as holding negative positions or overtrading, also negatively impact progress.

However, once beginners learn the patterns of the markets and start small, and make well-informed decisions, forex can become a good venture for them. Again, the market demands consistency, practice, discipline, and lots of patience for it to work in your favor.

Don't wait and join Tradin today to start practicing with a demo account to build on your skills and take your journey to the next level.