When you're trading, choosing the right forex broker can make or break your trading journey. The forex broker is closely tied to execution speed, trading fees, and potential profitability. That's why traders must opt for a broker that runs on strict regulatory supervision, offers robust market research, and advanced analytical tools. A good forex broker provides access to a variety of assets and well-knit customer support.

For each trading style, there may be different brokers to select. For instance, scalpers require fast execution. Day traders may require stable platforms for smooth trading. That’s why traders need to choose the right broker so they can enjoy the best profits and performance consistency.

In this article, you’ll learn:

Process to choose the best broker

Differentiating between different styles to pick a suitable broker

Common mistakes to avoid while choosing a broker

Ready to start trading confidently? Join Tradin today to trade in a regulated environment and take your trading to the next level.

Understanding Different Trading Styles

To select the best broker, traders must understand different trading styles.

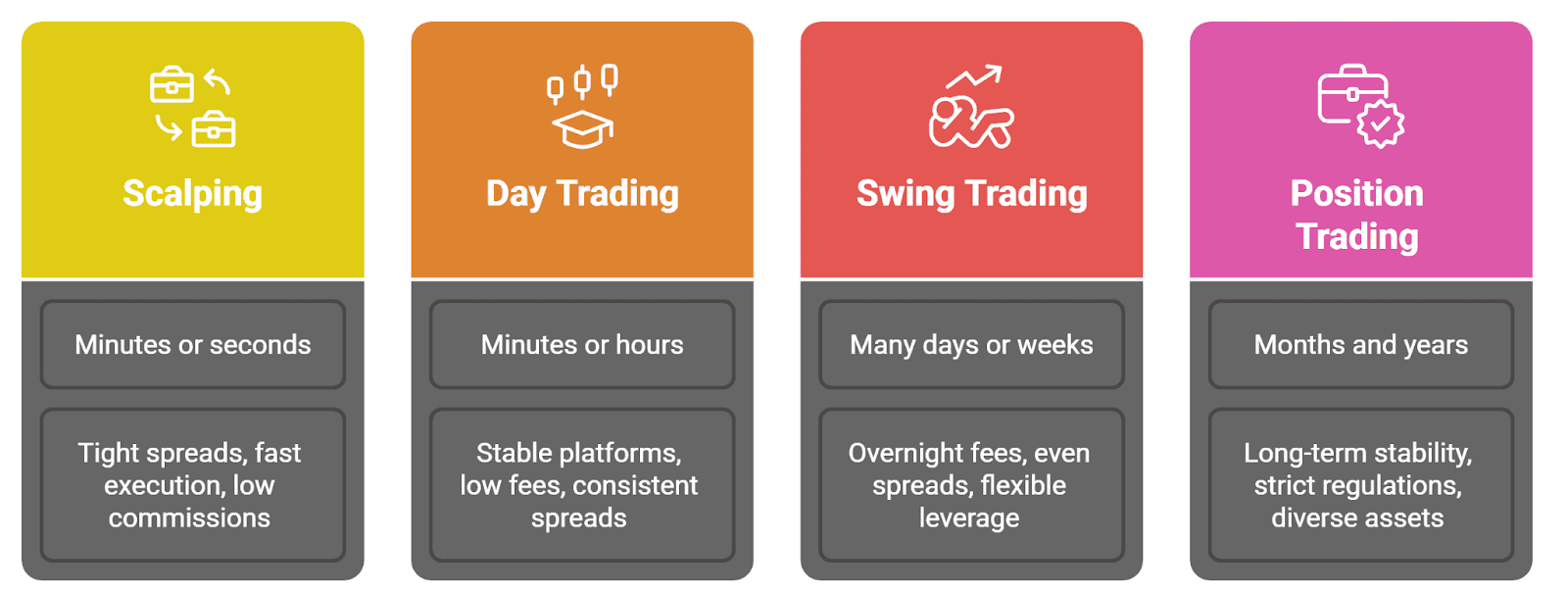

Scalping:

In scalping, traders hold positions for a few minutes or seconds, making quick entries and exits several times in a session. So, they need tight spreads, fast execution, and low commissions to profit from small price movements.

Day Trading:

Day traders hold and liquidate positions on the same day. Hence, they require stable platforms, low fees, and consistent spreads to experience a smooth journey to maximize their performance.

Swing Trading:

Swing traders hold positions for many days or weeks. They require paying overnight fees, spreads, and commissions. Moreover, they need flexible leverage to sustain costs efficiently.

Position trading:

Position traders hold currency for months and years until a significant trend reversal occurs. They require long-term stability, strict broker regulations, and a range of assets to diversify their portfolio.

Each of these trading styles requires different factors for best optimization. For long-term success and efficiency, traders must match their style with the right broker. Luckily, Tradin offers the best combination for all types of trading styles.

Key Factors to Consider When Choosing a Forex Broker

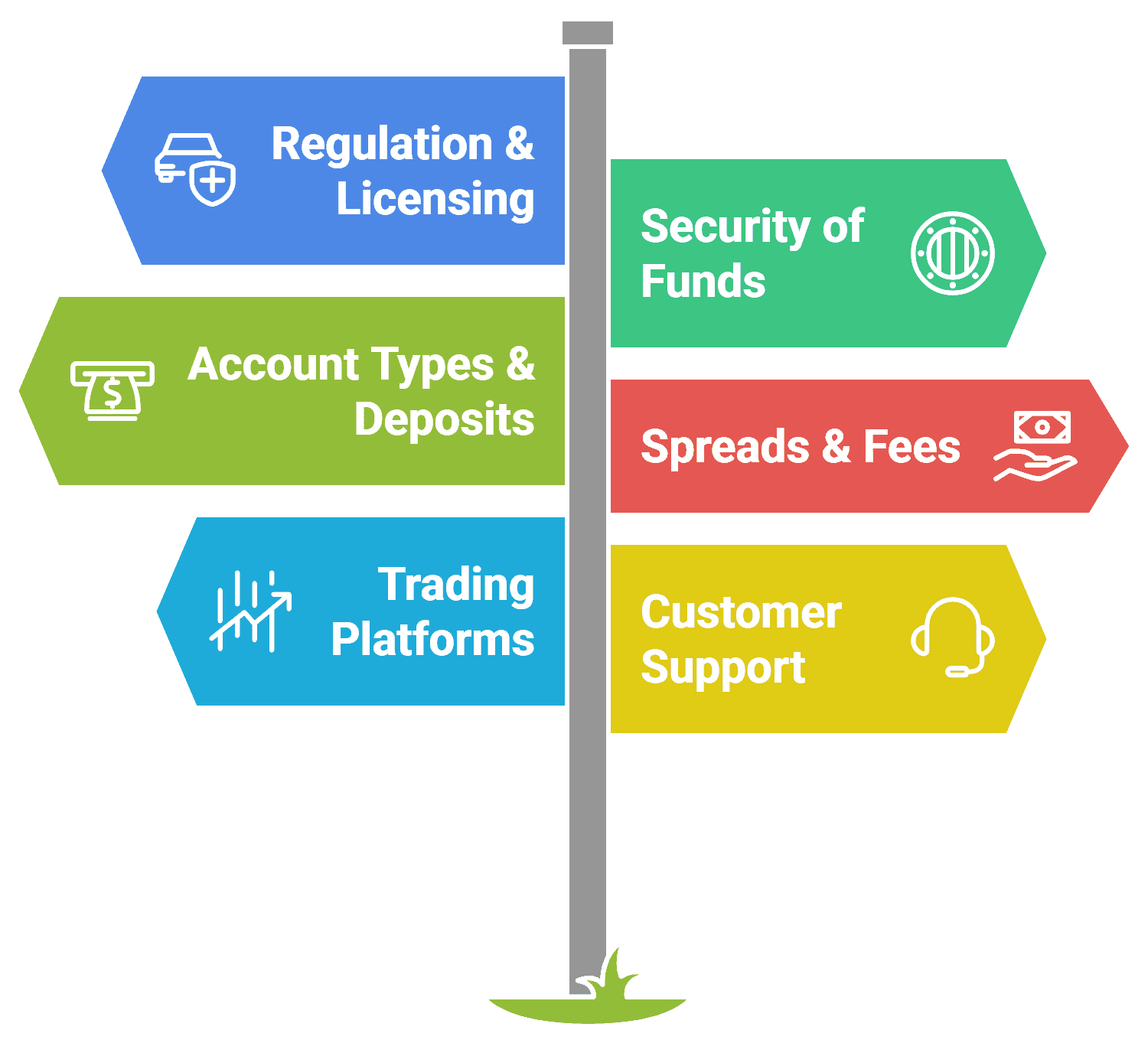

When choosing a forex broker, traders must do their due diligence properly and consider these key factors to avoid costly mistakes.

Evaluate regulation and licensing, as these ensure the law is followed and protect traders from any potential fraud.

Security of funds is essential, as it keeps traders safe from non-trading risks. Hence, pick a broker that holds funds in segregated accounts.

Account types and minimum deposits help traders determine what is more suitable for their overall budget.

Make sure you see spreads, commissions, and hidden fees to avoid any inconvenience with your profitability.

It should offer popular trading platforms and tools, such as MetaTrader 4, MT5, and cTrader.

Customer support quality makes a huge difference. If it's fast and reliable, your issues can get fixed at the speed of light.

Comparing Forex Brokers Based on Your Style

For optimal performance, traders must select a broker that aligns with their preferences, objectives, risk tolerance, and trading style. For each style, the forex broker could be different.

Best Brokers for Scalpers and Day Traders

The best broker type for scalpers and day traders is one that provides accounts with speedy execution and tighter spreads. Additionally, low commissions are beneficial, and if they provide VPS or API connections, that is the cherry on top, as it enhances reliability and speed.

Best Brokers for Swing and Position Traders

For swing and position traders, the ideal broker choice is the one that offers long-term stability and transparent overnight swap rates. Additionally, since these traders typically hold positions for several weeks to months, the broker must have a strict regulatory system in place to provide protection.

Best Brokers for Beginners vs. Advanced Traders

Beginner traders can benefit from forex brokers that offer micro accounts, have low deposit requirements, provide stable platforms like MetaTrader 5, and offer comprehensive educational resources. These ensure a smooth trading experience for those new to the market.

For advanced traders, professional accounts, advanced technical and analytical tools, and a variety of platforms like cTrader seal the deal.

Traders should opt for a broker that ensures low slippage and requote, low costs, and long-term stability without hidden fees or rules.

Whether you're a beginner or an advanced trader, join Tradin today and start trading with tools built explicitly for your trading style.

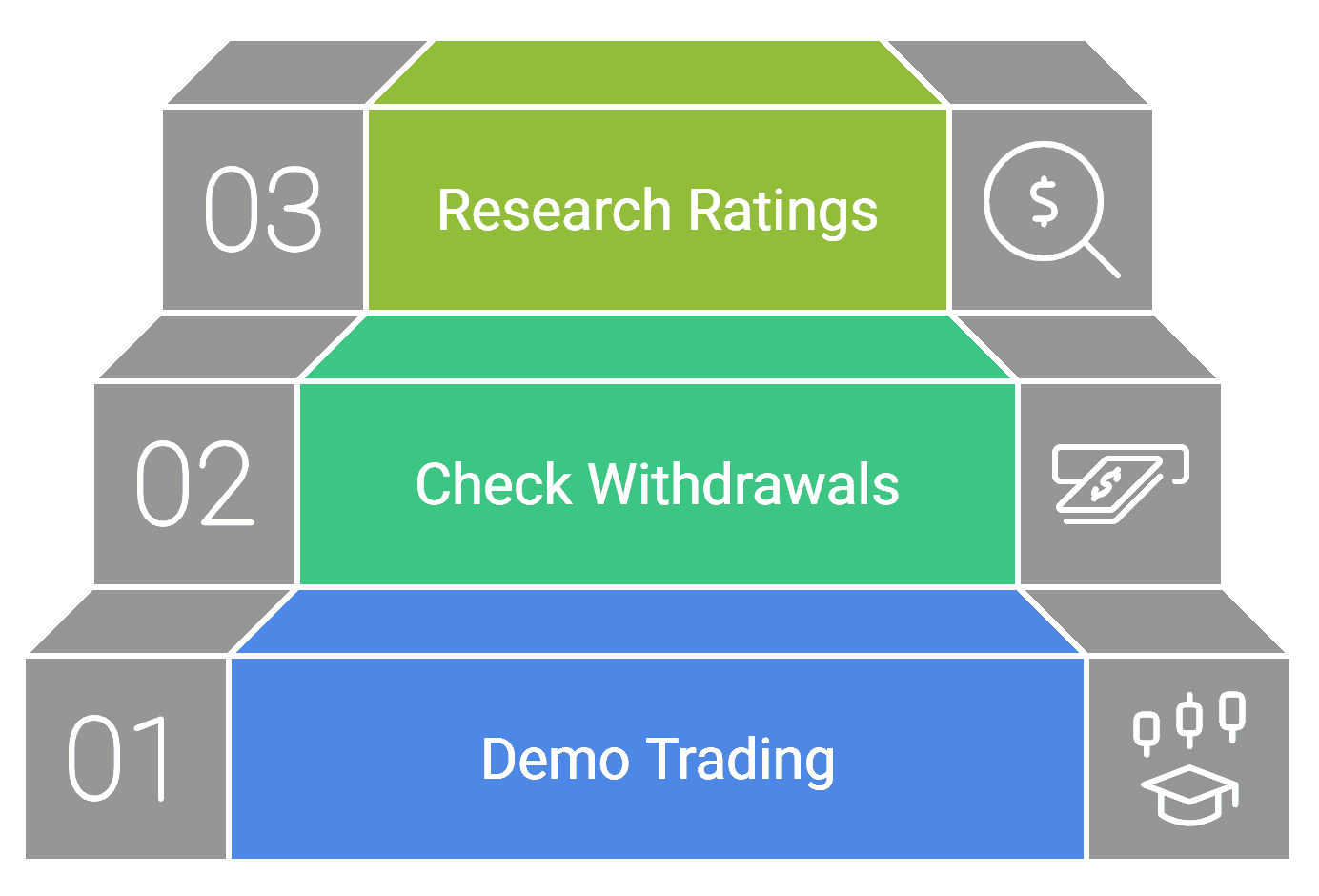

Testing and Verifying Your Broker Choice

Before committing to any broker, traders must test and verify the broker choice to know what they are signing up for. The first step is to practice trading with a demo account to test execution and the broker’s platforms. Follow it by checking the deposit and withdrawal processes. Make a small deposit and withdraw it. This helps to see if the transactions are quick and smooth.

Lastly, do further research and review independent broker ratings from credible forums. Make sure your broker is reliable, safe, reputable, and can meet your trading needs and wants.

Common Mistakes to Avoid While Selecting a Forex Broker

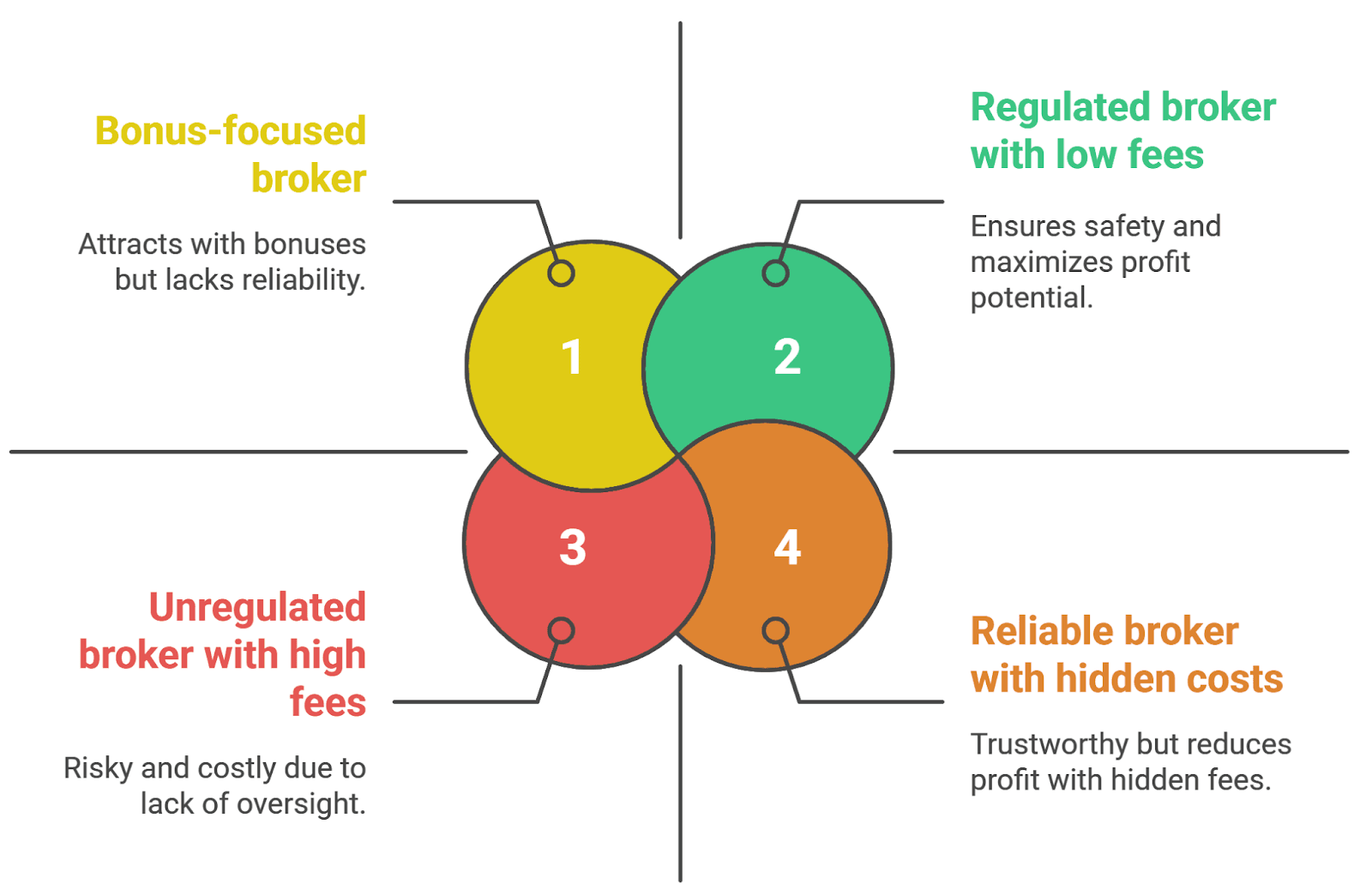

When traders select a forex broker, they often end up making costly mistakes, which could have otherwise been avoided had they done their due diligence. Some of these include:

Choosing brokers based only on bonuses is a telltale sign of an unreliable broker. A broker should provide steady and stable growth.

Ignoring regulation and safety can land traders in deep trouble as they may lose their capital to fraud or risky practices.

Overlooking hidden costs, such as withdrawal fees or swaps, reduces profitability in the long run and can become a psychological strain.

Additionally, traders should test the customer support to ensure they respond in a timely and efficient manner, thereby avoiding potential losses.

Conclusion

Traders must learn how each broker operates to determine which one works best for their trading style, budget, and time commitment. Choosing the right broker directly impacts the trading cost, execution speed, potential profits, and potential risks. Always do in-depth research and trade with a demo account before committing to any forex broker to avoid any potential heartbreaks.

Ready to trade like a pro? Join Tradin today, test out the demo account, and find the difference in services and commitment.