In 2025, volatility, economic divergence, and shifts in central bank policy have become the norm in trading financial markets. Whether they trade major or minor currency pairs, they must stay vigilant, regardless of liquidity or shifting price trends. That's why forex traders should select the right currency pairs that can provide ample trading opportunities and help them survive such circumstances.

To perform well, the key is understanding how different pairs react to the varying market conditions. Additionally, aligning them with your risk tolerance, appetite, and strategy could be advantageous. This article helps traders understand:

Best currency pairs to trade in 2025 for beginners

Why does currency pair selection matter?

How to find the right fit?

How to optimally perform in forex trading?

Ready to start trading popular currency pairs and quick execution? Join Tradin today and trade with comfort and credibility.

Why Choosing the Right Currency Pair Matters

To increase their trading efficiency, traders must select the right currency pair. Liquidity, volatility, and trading cost directly affect returns on trading. Each forex pair serves a distinct purpose in the trading process. For instance, major pairs like EUR/USD offer the maximum stability and liquidity. Thus, it provides tight spreads and lower costs, making it the perfect deal for beginners.

Minor pairs, such as EUR/GBP, offer more diversity, making them the best package for intermediate traders. Lastly, exotic pairs like USD/TRY offer low liquidity but high volatility. Currency pairs with high volatility in 2025 include USD/ZAR, USD/MXN, GBP/JPY, GBP/AUD, and EUR/SGD. Consequently, the spreads are wider, and the risk is even higher than that. So, they are the perfect match for seasonal traders. Remember, market volatility determines the risk and opportunities. Always ensure that you align your objectives, trading style, and risk tolerance to achieve the best results.

Criteria for Selecting Top Forex Pairs in 2025

When selecting the top forex pairs, traders must assess various aspects. This requires examining and evaluating:

Economic outlook

Monetary policy

Interest rates

Market volatility

Market volume

But the question arises: why do traders have to go by this rule book? If an economy is strong, it will support a strong currency, highlighting the role of growth forecasts in trading. The central bank’s monetary policies and interest rates are crucial factors to watch. A rate hike will lead to increased demand for the currency. However, if there is a rate cut, the respective currency will see reduced demand.

Additionally, market volatility and volume are other key factors, as highly liquid pairs typically offer tight spreads, while volatile pairs have wider spreads, offering higher risks and returns. Traders must conduct thorough due diligence before placing an order.

Top 5 Currency Pairs to Trade in 2025

The top 5 most traded forex pairs in 2025 include:

EUR/USD Outlook for 2025

The EUR/USD pair is at the forefront. It is highly traded due to its reputation for stability and liquidity. The pair's price action is influenced by the European Central Bank’s cautious approach compared to the Federal Reserve's policy outlook, which involves lowering interest rates. The pair offers trading opportunities because it responds to this policy divergence.

GBP/USD Predictions 2025

The GBP/USD pair is known for its volatility. Although the Covid aftershocks are fading, the UK still grapples with inflation, which is why the Bank of England attempts to keep interest rates steady. Due to this, there is a swing between the pound and the dollar. The GBP/USD is highly reactive to economic releases, offering a high pip range, and exhibits clear technical patterns.

USD/JPY Trading Opportunities 2025

The USD/JPY pair is characterized by interest rate divergence between the Fed and BOJ. Japan’s interest rates are already very low. Meanwhile, the US has started lowering its rates. In such volatile times, the Japanese yen serves as a haven for investors due to its stable nature. Additionally, the pair offers trading opportunities for 2025, as it provides strong performance during both riskier and less volatile cycles.

AUD/USD Outlook for 2025

Commodity prices drive the AUD/USD pair. Australian iron ore, copper, and coal are in high demand. China is recovering from its economic downturn, which means it will likely increase its purchases from Australia. This will further strengthen the AUD, while the US dollar is facing a shift in momentum after a several-year bull run.

USD/CAD Outlook for 2025

The USD/CAD is closely tied to oil prices, as Canada is a significant oil exporter. If the oil prices increase, the CAD strengthens. This softens the USD/CAD. The US works in parallel with its interest rates, addressing concerns about inflation and tariffs.

Potential Emerging Currency Pairs to Watch

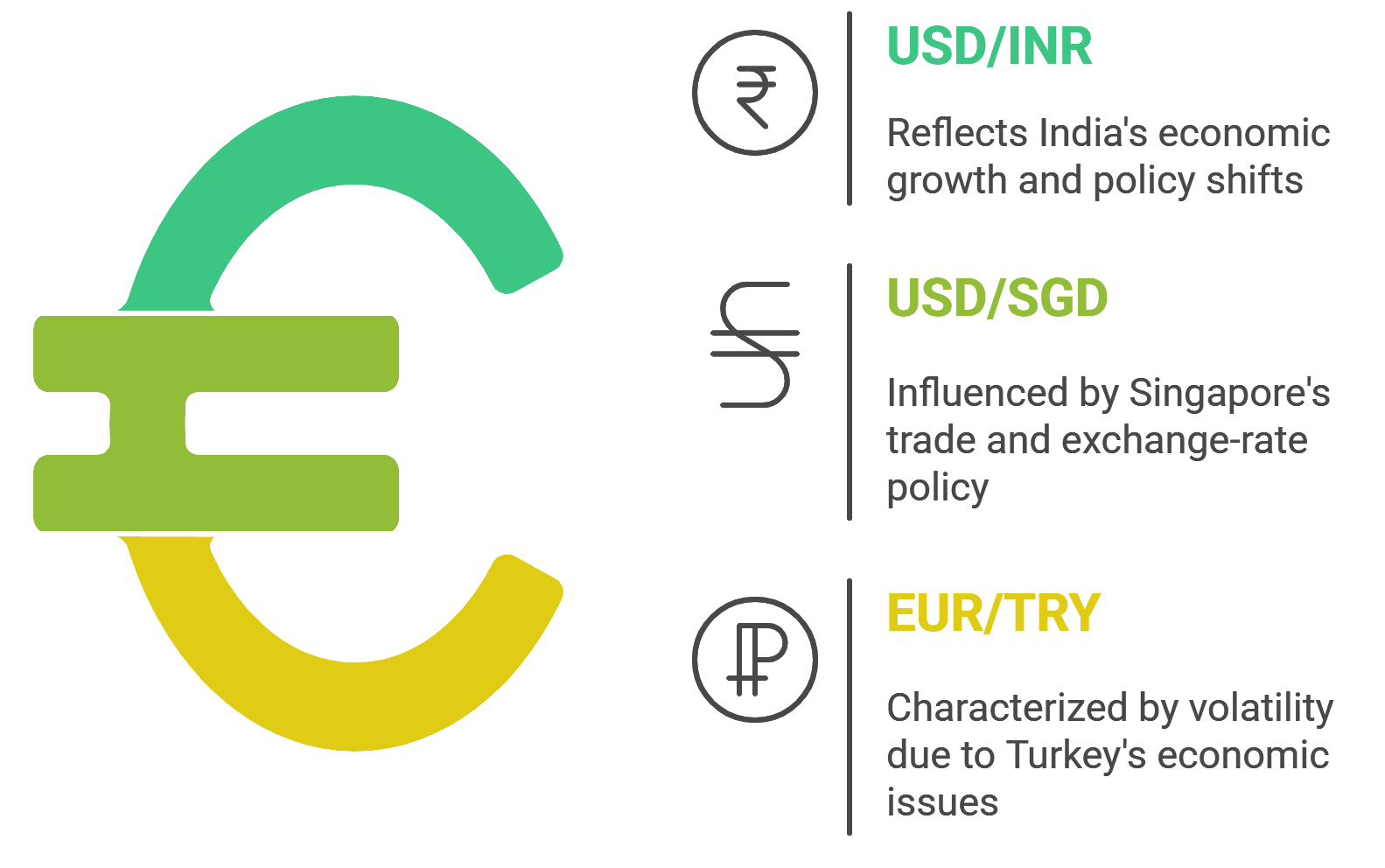

There are many emerging market currency pairs to watch in 2025, as they offer high reward and risk opportunities. Some of these include:

USD/INR: India’s economy is growing, and so is the global investment, due to which it can create profits.

USD/SGD: Singapore’s economy is stable but is very reactive to global news and interest rate shifts.

EUR/TRY: It remains highly volatile due to Turkey's policy uncertainty, which can make it a highly profitable trade.

All of these pairs offer higher risk and higher reward scenarios, but to manage them effectively, traders need to stay up-to-date with policy changes and global economic shifts to maximize their benefits.

Trading Strategies for 2025 Currency Pairs

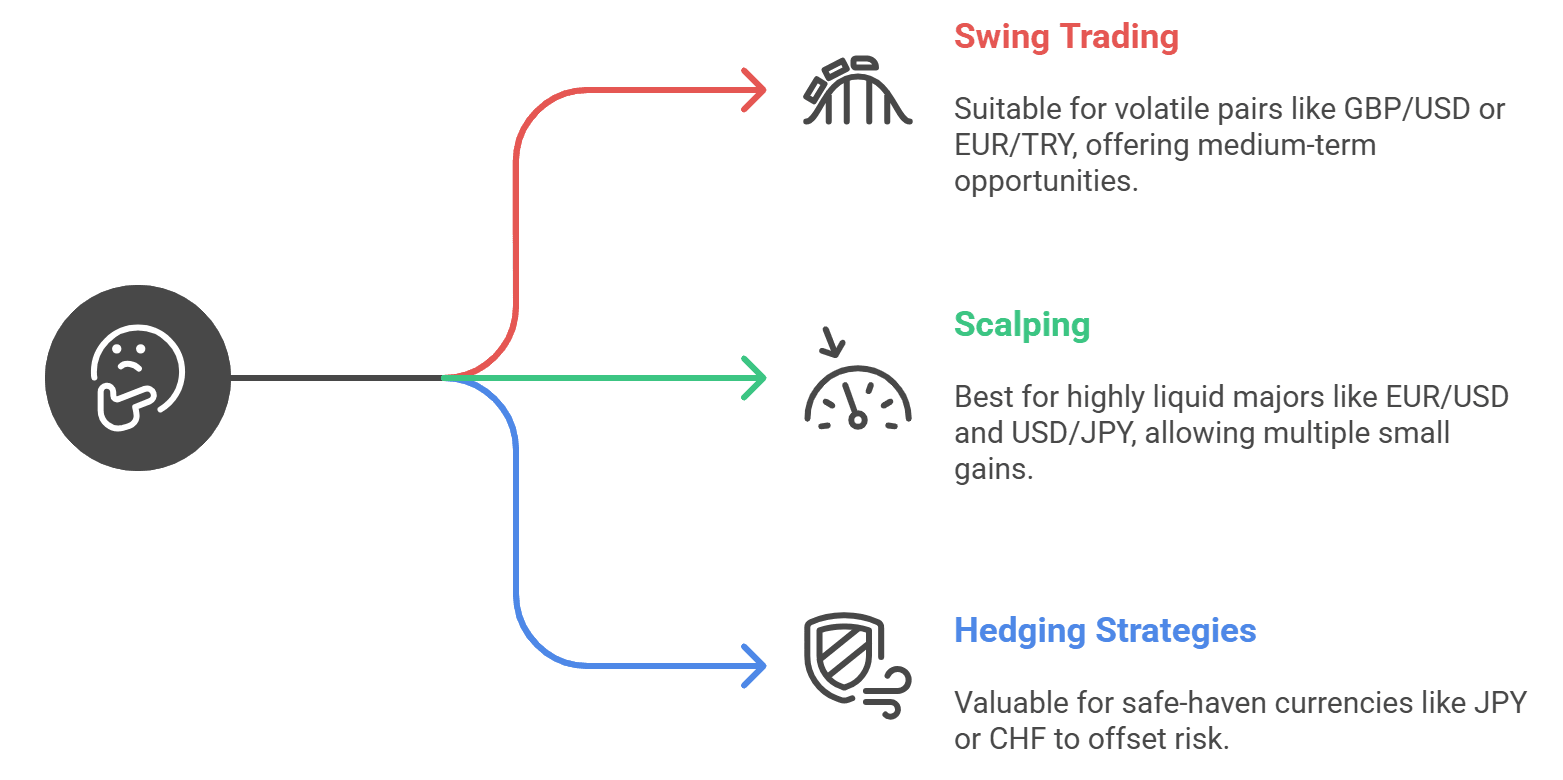

In 2025, traders need to apply their trading strategy to the appropriate trading instrument. The approach may differ for each pair.

Swing trading suits volatile pairs, such as GBP/USD. Scalping is most effective on major pairs that offer high liquidity, such as EUR/USD. Hedging strategies work well with safe-haven currencies, such as the JPY.

By making informed choices, traders can enhance consistency and execution, resulting in improved outcomes.

Risk Management in Forex 2025

To succeed in forex, the key is to manage risk efficiently. Some of the tips include:

Stop-loss orders are vital to safeguard capital, as they let traders exit positions promptly.

Managing leverage properly is crucial, as it amplifies both profits and losses.

Diversifying across pairs is a wise choice, as it reduces risk by providing balanced exposure to multiple currencies.

By applying such practices in their trading journey, traders can navigate their way through volatility, massive geopolitical shifts, and swinging interest rates to ensure long-term growth with discipline and consistency.

Conclusion

The most liquid currency pairs to trade for consistent profits in 2025 include EUR/USD, GBP/USD, USD/JPY, AUD/USD, and USD/CAD. There is no single safe currency pair to trade for consistent profits. All the mentioned pairs offer tremendous trading opportunities for forex traders, striking a perfect balance between stability and volatility. However, traders must match their trading profile and objectives with the correct currency pair for maximum profit. Moreover, readers must stay informed about market news and economic calendars to avoid uncertainties and unpleasant surprises. To succeed in forex, traders must continually adapt to the market as strategies and tools evolve.

Start trading with Tradin and align your strategy with your best fit to deal with ease and confidence in the forex market.