When trading forex, you must have observed that your profits don't match what they should have been. That's because many traders, especially beginners, are still unaware of the hidden costs that quietly eat away at traders' profits. Even though profits and losses are a part of the package, these hidden factors significantly impact your trading game if not managed the right way.

These costs are spreads, commissions, and swap fees in forex trading. The spread is the difference between the buy and ask price. Swap fees are overnight fees that depend on the relative difference between currencies you trade. Commissions are extra fees that some brokers charge. Together, these impact the returns. This article helps you:

Break these three main costs.

Learn how to avoid them.

How to select a good broker for efficient trading.

Ready to trade efficiently with low commissions and transparent spreads. Join Tradin today to enjoy better swap rates and an even better trading experience.

Understanding Forex Spreads

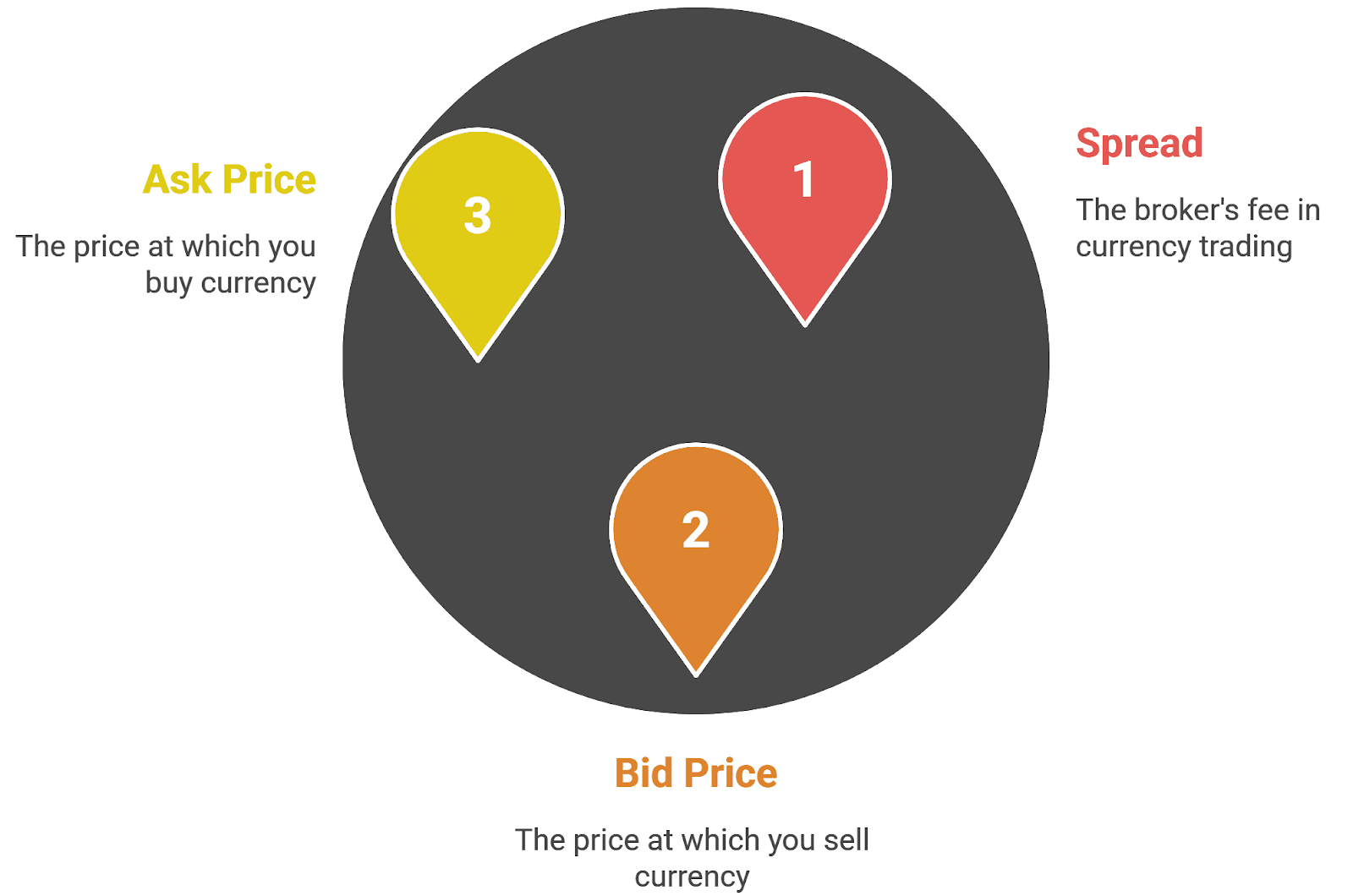

The spread is the difference between the bid and ask of the currency pair you trade. This represents the broker's built-in fee per trade. What are spreads in forex trading? For instance, the spread is 2 pips when the EUR/USD pair has an ask of 1.1000 and a bid of 1.0998. Also, spreads can be either fixed or variable.

The fixed spreads remain the same even under volatile conditions, while the variable ones change during such turbulent times, like news or economic events. The spreads are tighter for major pairs like EUR/USD, USD/JPY, GBP/USD, etc. It's because of the high liquidity. While the exotic pairs include currencies from emerging economies, they have wider spreads. For efficient and risk-averse trading, understanding spreads and knowing how to use them makes a lot of difference.

Forex Trading Commissions

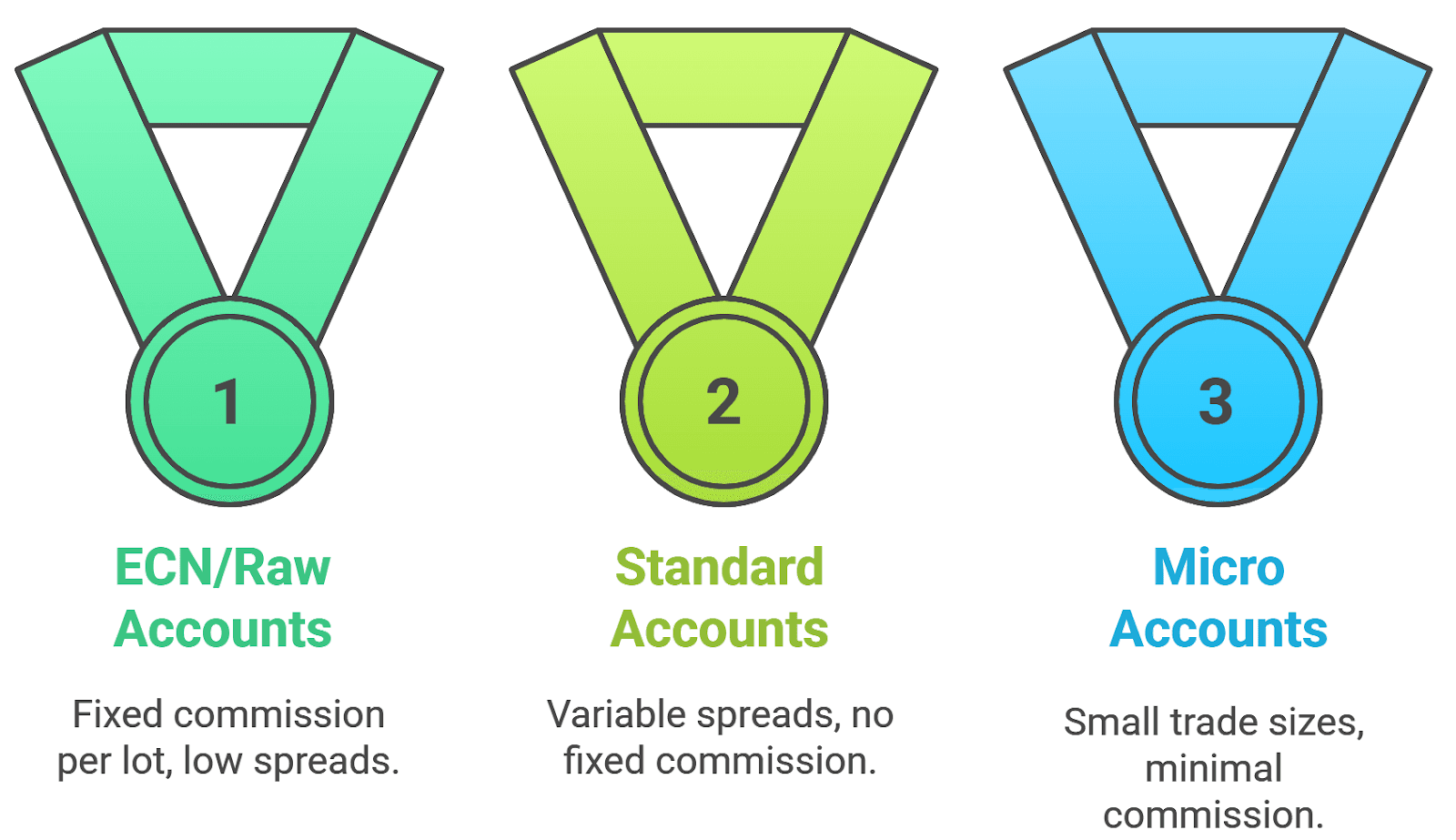

Some forex accounts charge a fixed commission on each trade that is calculated per lot. How commissions work in forex trading is simple: you usually pay a fee of $5 to $10 per lot. Commissions usually occur in accounts with low spreads known as ECN or raw accounts. The commission varies slightly depending on which broker you use. For instance, you might pay $5 to $10 per lot.

Additionally, scalpers and day traders have a lot to gain from commission accounts due to the low spreads, which impacts traders’ entry and exit points. Understanding commissions can reduce your transaction costs significantly.

Swap Fees (Overnight Financing Costs)

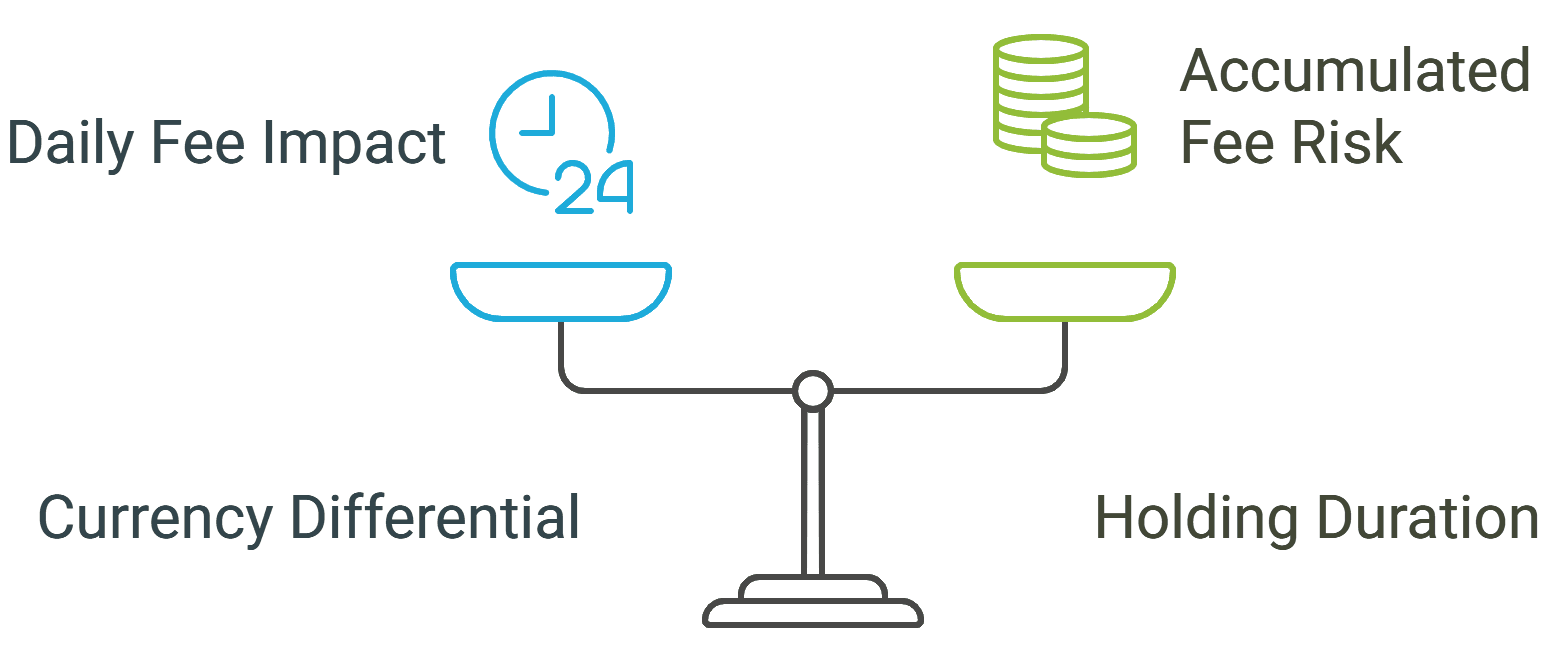

The swap fees, also known as rollover fees, are extra costs for holding overnight positions. Swap fees meaning in forex trading comes down to the interest rate differential between the two currencies in the pair. How swap rates affect overnight forex trading is important for swing and long-term traders, as these small costs accumulate when trades are held for days.

Additionally, traders either earn or pay a small amount depending on their position. The traders earn a positive swap from the interest rates when holding a higher-yielding currency.

If the traders pay up interest on the lower-yielding currency, they get a negative swap. Some factors impact the swap fees, such as currency interest rates and broker policies etc. To avoid or minimize swap fees, traders need to understand how it works. Before a rollover, traders can close positions to avoid any additional costs. Also, matching up the strategy with the positive swaps helps as well.

Note that the swap is charged/paid thrice on Thursday.

Comparing Spreads, Commissions, and Swaps

The spreads, commissions, and swap fees all affect your trading costs differently. For instance, scalpers are most impacted by spreads and commissions, while swing traders feel the effect of swaps. The difference between spread and commission in forex is that spreads are built into the price, while commissions are charged per lot. A forex trading fees comparison 2025 shows that scalpers should focus on spreads and commissions, while long-term traders should account for swap rates.

Type | Definition | Example |

Spread | It is the difference between the bid and ask of a pair. | If ask=1.1000 and bid=1.0998, then the spread is 2 pips. |

Commissions | It is the broker fee per lot/size. | $5 to $10 per lot. |

Swap Fees | It is the extra amount when holding an overnight position. | If EUR/USD is the traded pair, then the interest rate differential between EUR and USD is the swap fee. |

Also, each of these impacts traders depending on their strategy. For instance:

Scalpers get affected by commissions and spreads, mainly because of multiple entries a day.

Swing traders get affected the most by swap fees, as these build up in case of positions held over several days.

Swaps work against long-term traders, while they are less affected by commissions and spreads.

Choosing the Right Broker Based on Fees

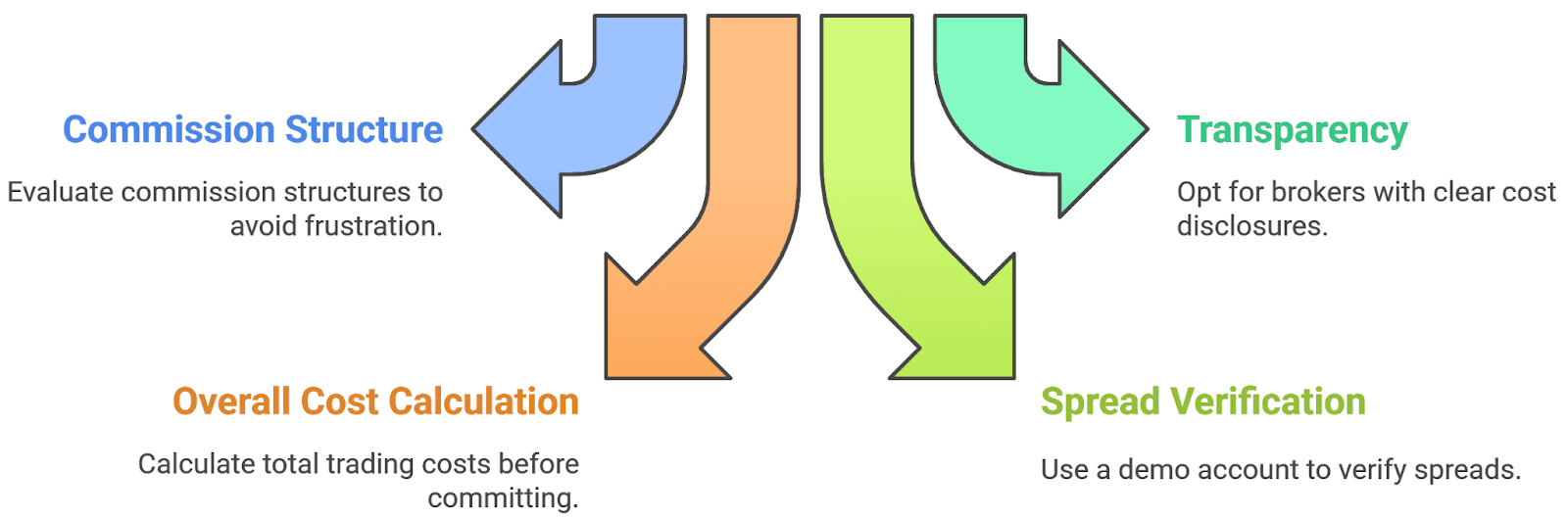

If traders want to optimise performance, they need to evaluate brokers carefully. Look for low spread forex brokers with low commissions if you are scalping or day trading. For longer-term strategies, consider the impact of swaps and look for the best brokers with zero commission and low swap fees. Always ensure the broker is regulated and transparent with its cost structure.

To decide between brokers, look at their commission structures and average spreads to optimize trading performance.

Always opt for a broker that clearly mentions all trading costs transparently.

Calculate the overall trading cost before committing to any broker.

To measure costs, multiply pip value per spread, then add commission per lot round turn.

For swap fees, measure the total holding period.

Also, for live verification of spread, use a demo account.

Any broker that is user-friendly and meets the regulatory requirements is reasonable enough.

Join Tradin today to trade in a regulated and transparent trading environment where you won't get any hidden surprises.

Practical Examples

To illustrate how spreads, commissions, and swap fees affect the potential profits, let’s imagine a trader who trades 1 lot of EUR/USD currency pairs with a spread cost of $1 and a commission of $7; then the total cost is $8. Now, if the swap fee is -$3, then the total cost becomes $11. However, the swap fee is charged on a daily basis.

Final Thoughts

While the forex market is full of opportunities, to make the best of them and maximize profitability, traders must educate themselves about the hidden costs and learn to manage these better for long-term growth and success. Choosing the best forex broker and fee structure is the key to unlocking the market's potential. Before committing to any broker, do your due diligence and never opt for one before going through each detail of the fee structure.

Start trading with Tradin to walk on the path of long-term growth with ease and clarity.